Discover a world of engaging word games and puzzles in PDF format, perfect for learning, entertainment, and cognitive development. Explore crosswords, word searches, cryptograms, and more, all easily downloadable and printable for fun and educational activities.

Overview of Word Games and Puzzles

Word games and puzzles are popular activities that combine entertainment with cognitive challenges. They include diverse options like crosswords, word searches, cryptograms, Sudoku, anagrams, and more, catering to all skill levels. These puzzles are widely enjoyed by both children and adults, offering mental stimulation and fun. The PDF format has become a preferred medium for sharing these games due to its ease of use, high-quality printability, and accessibility on various devices. Whether for educational purposes, leisure, or cognitive training, word games and puzzles in PDF format provide a convenient and engaging way to sharpen skills and enjoy some mental exercise. Their versatility makes them suitable for classrooms, personal use, or even therapeutic applications.

Importance of Word Games for Cognitive Development

Word games and puzzles play a vital role in enhancing cognitive development across all age groups. They improve memory, attention, and problem-solving skills, fostering intellectual growth. For children, these activities aid in vocabulary expansion and language proficiency, laying a strong educational foundation. Adults benefit from enhanced mental agility and stress relief, while seniors can experience improved cognitive function and delayed cognitive decline. Word games are particularly beneficial for individuals with conditions like dementia, as they provide therapeutic stimulation. Regular engagement with word puzzles can also boost confidence and overall mental well-being, making them a valuable tool for lifelong learning and brain health;

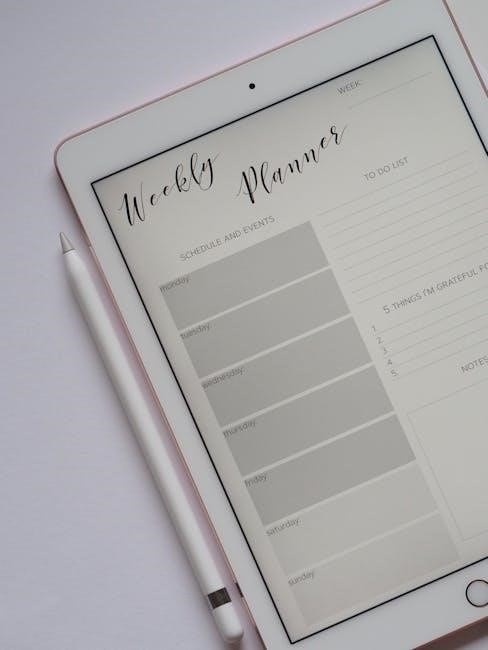

Why PDF Format is Ideal for Word Games and Puzzles

The PDF format is an excellent choice for word games and puzzles due to its universal accessibility and consistent formatting. PDFs can be easily downloaded and printed, ensuring high-quality visuals and readability across all devices. This format preserves the layout and design of puzzles, making them visually appealing and user-friendly. Additionally, PDFs are widely compatible, allowing seamless sharing and distribution. They are also ideal for creating themed puzzles for special occasions or educational purposes. With PDFs, users can enjoy a variety of word games and puzzles anytime, anywhere, making them a convenient and reliable option for both entertainment and educational activities.

Popular Types of Word Games and Puzzles

Explore diverse word games like word searches, crosswords, cryptograms, anagrams, and Sudoku, each offering unique challenges for entertainment, education, or cognitive development, suitable for all ages and skill levels.

Word Search Puzzles

Word search puzzles are a beloved and engaging activity where players locate hidden words within a grid of letters. These puzzles are suitable for all ages and cognitive levels, offering a fun way to improve vocabulary and observational skills. Available in themed designs, word search puzzles can cater to specific interests, such as holidays, animals, or academic subjects. Easily downloadable in PDF format, they are perfect for printing and sharing. Many free resources include answer keys, ensuring users can verify their progress. Themed word searches add an extra layer of excitement, making them ideal for classrooms, personal enjoyment, or therapeutic activities. Their versatility and accessibility make them a popular choice for learning and entertainment.

Crossword Puzzles

Crossword puzzles are a classic and engaging word game where players fill in words into a grid based on given clues. These puzzles are widely popular in newspapers, magazines, and online platforms. Available in various difficulty levels, crosswords cater to both beginners and experienced solvers. Many free printable crossword puzzles in PDF format can be downloaded, offering a convenient way to enjoy this activity at home or in classrooms. They are often themed around specific topics, making them a versatile tool for learning new vocabulary or testing knowledge. Crosswords are also used therapeutically to stimulate the mind and improve cognitive function. Their structured format and challenging clues make them a timeless favorite for word game enthusiasts of all ages.

Cryptograms and Code Crackers

Cryptograms and code crackers are intriguing word puzzles where players decode hidden messages or phrases. These puzzles typically use substitution ciphers, where each letter is replaced by another, challenging solvers to crack the code. Available in PDF format, cryptograms are easily downloadable and printable, making them accessible for both casual enjoyment and educational use. They are particularly popular for their ability to enhance problem-solving skills and vocabulary. Many free resources offer themed cryptograms, catering to various interests and skill levels. For educators, these puzzles are valuable tools for teaching critical thinking and language comprehension. Additionally, cryptograms are used therapeutically to stimulate the mind and improve cognitive function in individuals with dementia or other cognitive disorders. Solvers can start with simpler codes and progress to more complex ones as their skills improve.

Anagrams and Word Scrambles

Anagrams and word scrambles are engaging word games that challenge players to rearrange letters to form valid words or phrases. These puzzles are perfect for improving vocabulary, problem-solving skills, and cognitive agility. Available in PDF format, anagrams and word scrambles are widely accessible for download and print. They cater to all age groups, making them ideal for both children and adults. Themed anagrams, such as those focused on specific topics or events, add an extra layer of fun and educational value. Many free resources offer customizable anagram puzzles tailored to individual skill levels or learning objectives; Solving anagrams also enhances memory retention and linguistic creativity, making them a popular choice for classroom activities and personal enrichment.

Sudoku and Logic Grid Puzzles

Sudoku and logic grid puzzles are number-based games that challenge players to fill grids following specific rules, often complementing word games in puzzle collections. While primarily numeric, they enhance cognitive skills like logical reasoning and problem-solving, which also benefit word puzzle enthusiasts. Available in various difficulty levels, Sudoku is widely popular and often included in PDF puzzle books alongside word games. These puzzles are ideal for mental stimulation and relaxation, offering a refreshing break from word-based challenges. Printable Sudoku PDFs are easily accessible, making them a great addition to personal or educational puzzle collections. They provide a strategic workout for the mind, promoting focus and analytical thinking, while also being a fun and rewarding activity for all ages.

Benefits of Word Games and Puzzles

Word games and puzzles enhance cognitive skills, improve memory, and boost problem-solving abilities. They promote mental stimulation, vocabulary expansion, and logical thinking, benefiting all ages and skill levels.

Cognitive Benefits for Adults

Engaging in word games and puzzles offers significant cognitive benefits for adults. Activities like crosswords enhance vocabulary and memory, while Sudoku and logic grids improve numerical reasoning and problem-solving skills. Cryptograms and anagrams stimulate critical thinking and mental agility. These exercises keep the mind sharp and can contribute to better cognitive health, especially as adults age. With a variety of options available in PDF format, adults can easily access and print puzzles tailored to their interests and skill levels. This convenience makes it simple to incorporate these mentally stimulating activities into daily life, whether at home, during commutes, or in social settings, promoting ongoing cognitive wellness and enjoyment for all.

Educational Value for Children

Word games and puzzles in PDF format offer immense educational value for children, enhancing their learning experience through fun activities. These exercises improve spelling, vocabulary, and problem-solving skills, making them ideal for school or homeschooling. Themed word searches and crosswords tailored to specific subjects or CEFR levels help build knowledge in areas like science, history, or language arts. Interactive puzzles foster critical thinking and logical reasoning, preparing children for academic challenges. With customizable PDFs, educators and parents can create age-appropriate puzzles that cater to different learning stages, ensuring engaging and effective skill development. These tools are invaluable for fostering a love of learning and intellectual growth in young minds.

Therapeutic Use for Dementia and Cognitive Disorders

Word games and puzzles in PDF format are increasingly used as therapeutic tools for individuals with dementia and cognitive disorders. These activities provide mental stimulation, helping to maintain cognitive function and slow progression. Engaging in word searches, crosswords, and anagrams can improve memory recall and focus. Tailored puzzles, such as those found on Maria’s Place, offer activities designed for different cognitive stages, ensuring accessibility for all. Regular practice with these exercises fosters a sense of accomplishment and calm, reducing stress and anxiety. Caregivers and therapists often recommend these resources as part of daily routines, promoting mental well-being and providing a meaningful way to stay mentally active and connected.

Free Printable Word Games and Puzzles PDF

Access a variety of free printable word games and puzzles in PDF format, including crosswords, word searches, and cryptograms, perfect for all ages and skill levels.

Where to Find Free Word Games and Puzzles Online

Find a wide range of free word games and puzzles online at websites like PrintItFree, Maria’s Place, and others. These platforms offer downloadable PDFs of word searches, crosswords, cryptograms, and more. Many sites cater to specific needs, such as puzzles for children, adults, or seniors. Websites like PrintItFree provide adult puzzles, including cryptograms and Sudoku, while Maria’s Place offers engaging activities for dementia patients. Themed puzzles for special occasions and educational purposes are also available. Simply browse, select, and download your preferred puzzle in PDF format for instant fun and learning. These resources are perfect for teachers, parents, and puzzle enthusiasts alike, ensuring endless entertainment and cognitive stimulation.

How to Download and Print Word Games PDF

Downloading and printing word games PDFs is a straightforward process. Visit websites like PrintItFree or Maria’s Place, where you can browse various puzzles. Once you find a puzzle, click the download button to save the PDF to your device. Ensure your printer is set to A4 size for optimal results. Open the PDF using a reader like Adobe Acrobat and select the print option. Choose your printer and settings, then print. Many PDFs include answer keys, making it easy to verify solutions. This method allows quick access to puzzles, ensuring fun and educational activities for all ages; Print and enjoy word searches, crosswords, and more with just a few clicks.

Customizing Word Games for Specific Needs

Customizing word games and puzzles allows you to tailor activities to individual preferences or requirements. For educators, puzzles can be designed to focus on specific vocabulary or themes, aligning with curriculum goals. For language learners, games can be adapted to match CEFR levels, ensuring relevance and effectiveness. Tools like puzzle generators enable the creation of personalized word searches or crosswords. Additionally, puzzles can be themed for special occasions or interests, making them more engaging. For therapeutic use, games can be simplified or enlarged for accessibility. Customization ensures that word games meet diverse needs, enhancing their educational and entertainment value while addressing specific cognitive or skill-based objectives.

Word Games for Learning and Entertainment

Word games and puzzles offer a fun and engaging way to enhance vocabulary, improve cognitive skills, and provide endless entertainment for both children and adults.

Vocabulary-Building Word Games

Vocabulary-building word games are an excellent way to enhance language skills. Crossword puzzles, word searches, and anagrams help users learn new words and their meanings in an engaging manner. These activities are particularly useful for students preparing for exams, as they often incorporate relevant terminology. For instance, puzzles tailored to CEFR levels ensure that learners at different proficiency stages can benefit. Additionally, themed word games make learning fun and contextual, allowing users to associate words with specific topics or occasions. Whether for children or adults, these games provide an interactive approach to expanding vocabulary effectively.

CEFR Level-Specific Word Games

CEFR level-specific word games are designed to align with the Common European Framework of Reference for Languages, catering to learners at different proficiency stages. These games are tailored to match the vocabulary and complexity appropriate for each CEFR level, ensuring targeted learning. For instance, games for B1 and B2 levels focus on intermediate to upper-intermediate vocabulary, helping learners expand their language skills effectively. Themed word searches, crosswords, and anagrams are structured to reinforce CEFR-level terminology, making them ideal for students preparing for exams or advancing their language abilities. This approach ensures that learners engage with content relevant to their proficiency, enhancing retention and fluency.

Themed Word Games for Special Occasions

Themed word games add a festive twist to learning and entertainment, making them perfect for holidays, events, or celebrations. From Christmas-themed word searches to Valentine’s Day anagrams, these puzzles cater to specific occasions, enhancing engagement. Teachers and parents can use these games to create themed lessons or activities, while individuals can enjoy them for fun. Many creators, like Helene Hovanec, offer free themed word puzzles, such as holiday-themed crosswords or summer camp word scrambles. These games are designed to be both educational and enjoyable, providing a unique way to celebrate special occasions while building vocabulary and cognitive skills. They are widely available in PDF format for easy download and printing, making them accessible for everyone to enjoy. Themed word games bring excitement and relevance to puzzle-solving, making them a great addition to any celebration or event.

Advanced Word Games and Puzzles

Explore advanced word puzzles featuring cryptograms, acrostics, and magic squares. Helene Hovanec’s contributions include complex puzzles for enthusiasts. Brainteasers and matching exercises challenge even seasoned players.

Helene Hovanec’s Contributions to Word Puzzles

Helene Hovanec, a renowned New York-based puzzle constructor, has made significant contributions to word puzzles, especially for children. She generously offers 16 free word search puzzles, blending fun with education. Her puzzles are designed to be engaging and accessible, making them ideal for classrooms and home use. Hovanec’s work emphasizes vocabulary building and cognitive development through play. Her puzzles are tailored to various skill levels, ensuring that both kids and adults can enjoy them. By creating themed and educational content, she has become a trusted name in the world of word games and puzzles.

Brainteasers and Matching Exercises

Brainteasers and matching exercises are popular components of word game PDFs, offering cognitive stimulation and fun. These activities challenge problem-solving skills, memory, and logical thinking. Matching exercises often involve pairing words or concepts, while brainteasers present riddles or puzzles that require creative solutions. Both are ideal for all ages, enhancing mental agility and vocabulary. Printable PDFs make them easily accessible for classrooms, homes, or personal use. Many collections, like those from PrintItFree, include these exercises alongside crosswords and word searches. They are versatile tools for entertainment, education, and even therapeutic purposes, making them a valuable addition to any word game collection.

Acrostics and Magic Squares

Acrostics and magic squares are captivating word game variations that challenge and entertain. Acrostics involve creating words or phrases where the first letters spell out a hidden message, often thematic. Magic squares, traditionally numerical, adapt to word games by arranging letters or words symmetrically. Both exercises enhance vocabulary, pattern recognition, and logical thinking. PDFs offer these puzzles in printable formats, ideal for educational or leisurely use. Helene Hovanec and other creators contribute such puzzles, making them accessible for diverse skill levels. These activities are perfect for classrooms, personal enjoyment, or cognitive training, providing engaging and mentally stimulating experiences across all age groups.

Creating Your Own Word Games and Puzzles

Design your own word games and puzzles using tools like PDF editors. Start simple, ensure clarity, and balance challenge with fun for engaging results.

Tools for Designing Word Games

Various tools are available for creating word games and puzzles, including Armored Penguin Crosswords, Crossword Forge, and EclipseCrossword. These tools allow users to design custom puzzles, such as crosswords, word searches, and anagrams, with ease. Many of these tools support PDF output, making it simple to share and print your creations. Additionally, online platforms like PuzzleMaker and WordSearchGenerator offer user-friendly interfaces for crafting puzzles tailored to specific themes or skill levels. These tools are ideal for educators, hobbyists, and professionals alike, ensuring high-quality results for both entertainment and educational purposes.

Tips for Constructing Engaging Word Puzzles

When designing word puzzles, start with a clear theme or purpose to keep players engaged. Use simple grids for word searches and ensure words are placed logically. For crosswords, balance difficulty by mixing easy and challenging clues. Incorporate vocabulary relevant to the audience, such as educational terms for students or themed words for special occasions. Test your puzzle with a small group to refine its difficulty and fun factor. Add hints or visual cues to guide players without making it too easy. Finally, ensure the puzzle is visually appealing and easy to read, especially in PDF format. These tips will help create engaging and enjoyable word puzzles for all skill levels.

Word Games for Special Needs and Seniors

Engage seniors and individuals with special needs with tailored word puzzles designed for cognitive stimulation and enjoyment. These activities cater to different abilities, fostering mental engagement and fun.

Puzzles Tailored for Seasoned Times of Life

Engage seniors with puzzles designed specifically for their enjoyment and cognitive stimulation. Word searches, crosswords, and Sudoku are popular choices, offering mental exercise and fun. Many puzzles are tailored to accommodate different cognitive stages, ensuring accessibility for all. Themed puzzles, such as those focusing on history or nostalgia, resonate deeply with older adults. Large-print options and simple designs cater to visual and dexterity challenges. These activities not only entertain but also provide a sense of accomplishment. Customize puzzles to suit individual preferences or group activities, making them ideal for both personal use and community engagement. They are a wonderful way to keep minds sharp and spirits high during later life stages.

Engaging Activities for Different Cognitive Stages

Word games and puzzles are versatile tools that cater to various cognitive stages, from children to seniors. For younger minds, activities like word searches and anagrams build vocabulary and problem-solving skills. Adults can enjoy challenging crosswords and Sudoku to sharpen memory and focus. For individuals with dementia, tailored puzzles provide therapeutic benefits, helping maintain cognitive function. These activities are designed to be accessible, with options like large-print puzzles for visual impairments. Whether for learning, entertainment, or therapy, word games adapt to different cognitive needs, ensuring engagement and stimulation across all life stages. Their flexibility makes them invaluable for educators, caregivers, and enthusiasts alike.

Modern Trends in Word Games

The surge in popularity of Wordle and crossword puzzles highlights modern trends in word games. Digital and printable formats offer engaging cognitive exercises for leisure and mental improvement.

Wordle and Similar Word-Based Games

Wordle has become a global phenomenon, inspiring a wave of word-based games that challenge players to guess hidden words within limited attempts. These games, often available in both digital and printable PDF formats, offer daily puzzles that sharpen vocabulary and cognitive skills. Players enjoy the thrill of solving word mysteries, making them ideal for casual entertainment and educational purposes. The rise of Wordle has also led to the creation of similar games, providing diverse options for word game enthusiasts. Whether accessed online or printed, these games cater to all ages and skill levels, making them a popular choice for mental stimulation and fun. Their simplicity and engaging nature have redefined modern word gaming experiences.

Digital vs. Printable Word Games

Digital and printable word games offer unique benefits, catering to different preferences and needs. Digital word games, like Wordle, provide convenience, accessibility, and interactive features, making them ideal for on-the-go entertainment. They often include progress tracking, hints, and multiplayer options, enhancing engagement. Printable PDF word games, such as crosswords and word searches, offer a tactile experience, fostering focus and traditional puzzle-solving joy. They are versatile for home, school, or therapeutic use. While digital games embrace modern technology, printable formats retain the charm of physical activity. Both options ensure fun and cognitive stimulation, appealing to diverse audiences and learning styles. The choice between them depends on personal preference and the desired experience.

Word games and puzzles in PDF format offer a versatile and engaging way to enhance cognitive skills, build vocabulary, and enjoy entertainment for all ages. From crosswords to word searches, these activities provide mental stimulation and educational value. They are easily accessible, printable, and adaptable to different needs, making them ideal for both learning and leisure. Whether for children, adults, or seniors, word games and puzzles are a timeless resource that fosters creativity and mental sharpness. With the convenience of PDFs, these games are readily available to download and share, ensuring endless hours of fun and intellectual growth for everyone. Embrace the world of word games and puzzles to keep your mind active and entertained!